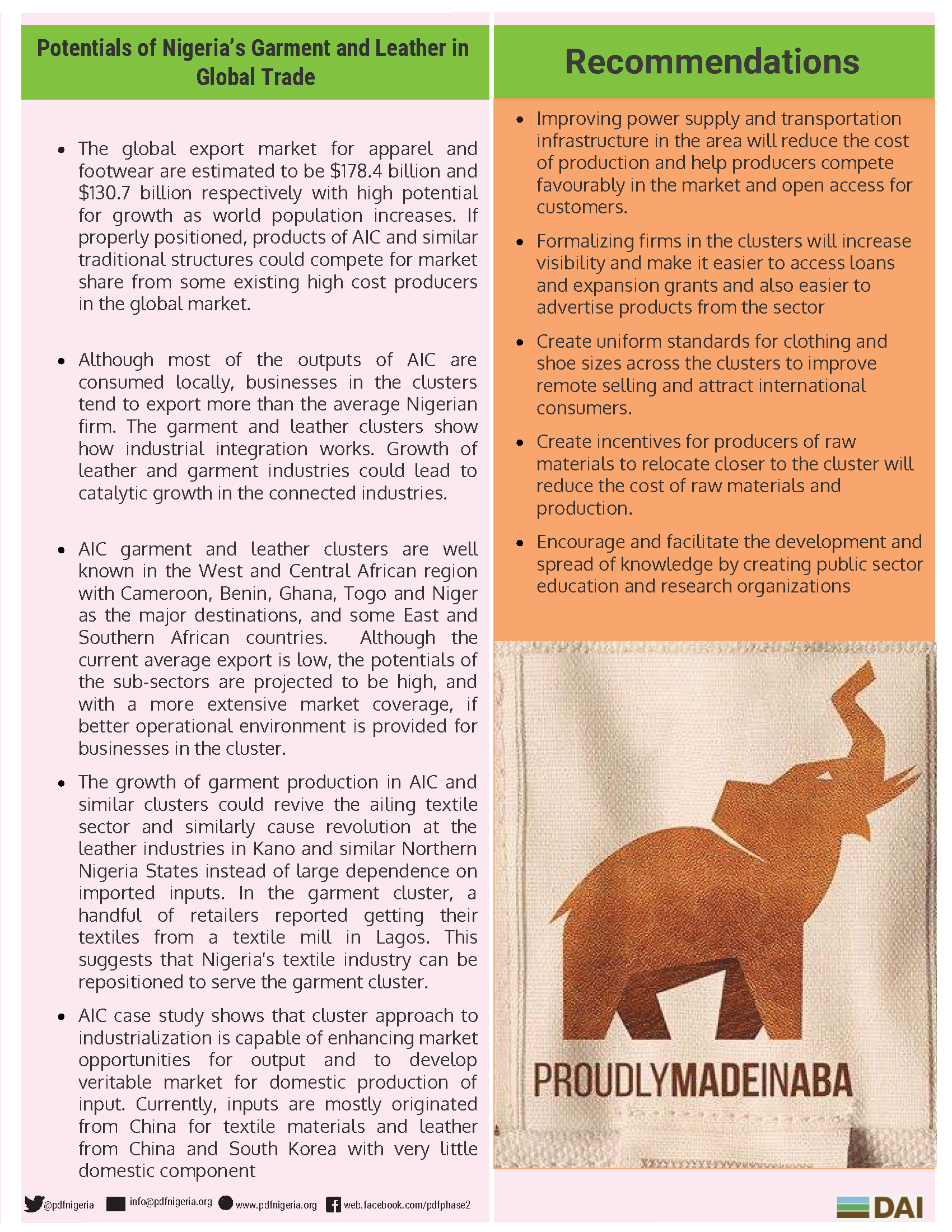

Aba Industrial City is an aggregation of thousands of MSMEs and mass producers of industrial goods including garment and leather products. If properly harnessed, the mass production capacities of component clusters of AIC and similar models are capable of positioning Nigeria at a competitive advantage in the global garment and leather industrial space. In 2016, the Textile, Apparel, and Footwear sector contributed N2 trillion ($6.6 billion), approximately 2% of Nigeria’s total GDP, to Nigeria’s economy.

Improving Nigeria’s Non-oil Exports: Aba Industrial City

File type: PDF

Number of pages: 4

File size: 636KB

Associated resources

Businesses that operate in a particular domain are expected to adhere to some rules and regulations. Here is a training material that covers some of these requirements. This does not take the place of legal advice.

Trade Associations play a role in promoting appropriate policies, regulations, and necessary reforms relating to their sector of operations. They create opportunities for networking and consultations among industry players as well as being a voice when it comes to new regulations and legislations while encouraging best practices among its members. According to Peter Gomersall[1], trade associations exist to support their members and further their interests, to defend them when they are under threats and to promote a common position on issues affecting the environment in which they operate.

Given the foregoing, the PDF Bridge Trade Policy Workstream organised a two-day capacity-building session targeted at strengthening the leadership of non-oil export-related trade associations and improve on their business strategy to position them to take advantage of the opportunities in the non-oil export value chain. The sessions had in attendance delegates from government agencies such as FMITI, NAQS, FMARD, NOTN, CBN as well as executives of trade group drawn from various industries including agricultural commodities farmers, agricultural commodities exchange and aggregators, industrialists, agro-processors, women, and youth development groups, textile and apparel among other participants.

[1] https://www.iiste.org/Journals/index.php/JEDS/article/download/7852/8030

This study conducted by PDF with support from FCDO (formerly DFID) shows that women who engaged in cross border trade contribute to food security by trading food products from areas of surplus to areas of deficit. The paper reveals that depending on how this trade is organized, these women have the potential to contribute significantly to household earnings and resources. This empowers women by giving them financial independence and control of their own resources.

Africa’s contribution to global trade in services is little with slow growth despite rapid globalisation and liberalisation. The continent’s intra – African trade in services is also relatively little. Nigeria’s services sector contribution to its GDP is huge, representing 55.8 per cent in 2017. It recorded a growth rate of 1.83percent in 2018. Hence, the services sector possesses the immense potential to promote diversification, employment, and growth, even without a current holistic services sector policy. This study specifically mapped and profiled key services sectors; reviewed domestic regulations relating to services; estimated the current and future potentials for export, and provided associated recommendations.

The Trade Policy Work Stream started out by conducting a needs assessment to get direct feedback from export-oriented MSMEs, export-supporting government institutions, and export business service providers to ascertain the capacity gaps. The top 5 challenges highlighted by the respondents include lack of market linkages, lack of finance, lack of market intelligence, limited knowledge of destination country requirements, and Export documentation.

Respondents were further asked about what they would like to see if there is an opportunity for assistance with capacity building for export readiness and export market access. Each responded provided its top 3 areas of preference for capacity building. The findings from the overall assessment provided a guide on areas to address.

In response to their needs, TRD workstream designed a targeted capacity building for the non-oil export community of practice to address the knowledge and skill gaps through a 4-part Export Capacity Building (CB) Series.