Non-oil exporters dialogue (Forum 6)

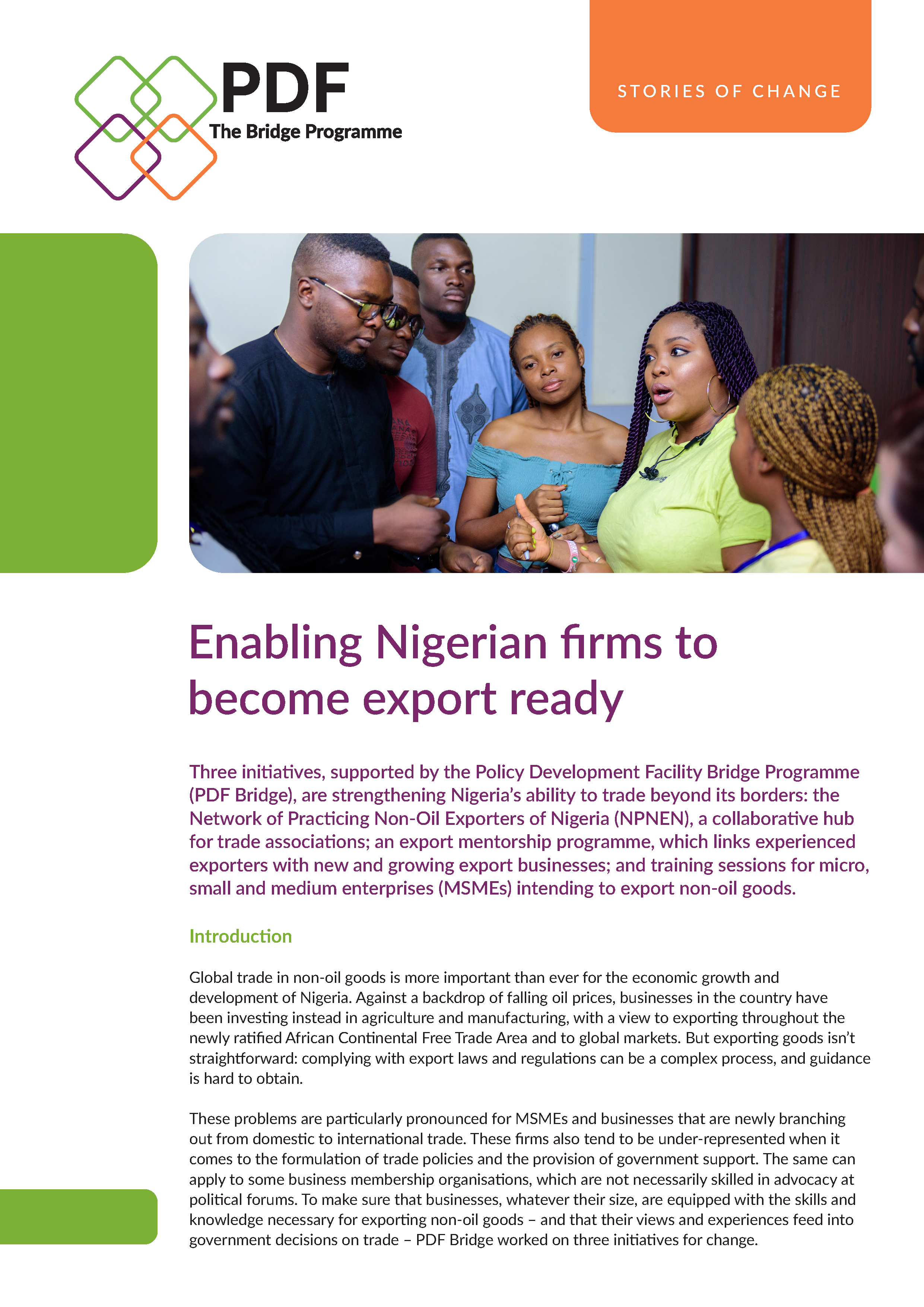

Micro, small and medium-scale enterprises are significantly represented among businesses involved in formal and informal cross-border trade and non-oil export, but many are unable to participate competitively due to challenges in the business environment. To support efforts to effectively position Nigeria’s micro, small and medium-scale enterprises for the global market, Policy Development Facility Phase II organised a series of forums aimed at improving access to finance for non-oil exporters and at developing non-oil exports in Nigeria. This report summarises the sixth forum in the series, and focuses on ‘Improving Trade Competitiveness and Business Environment in the South East’.