Made in Aba Cluster Mapping Report

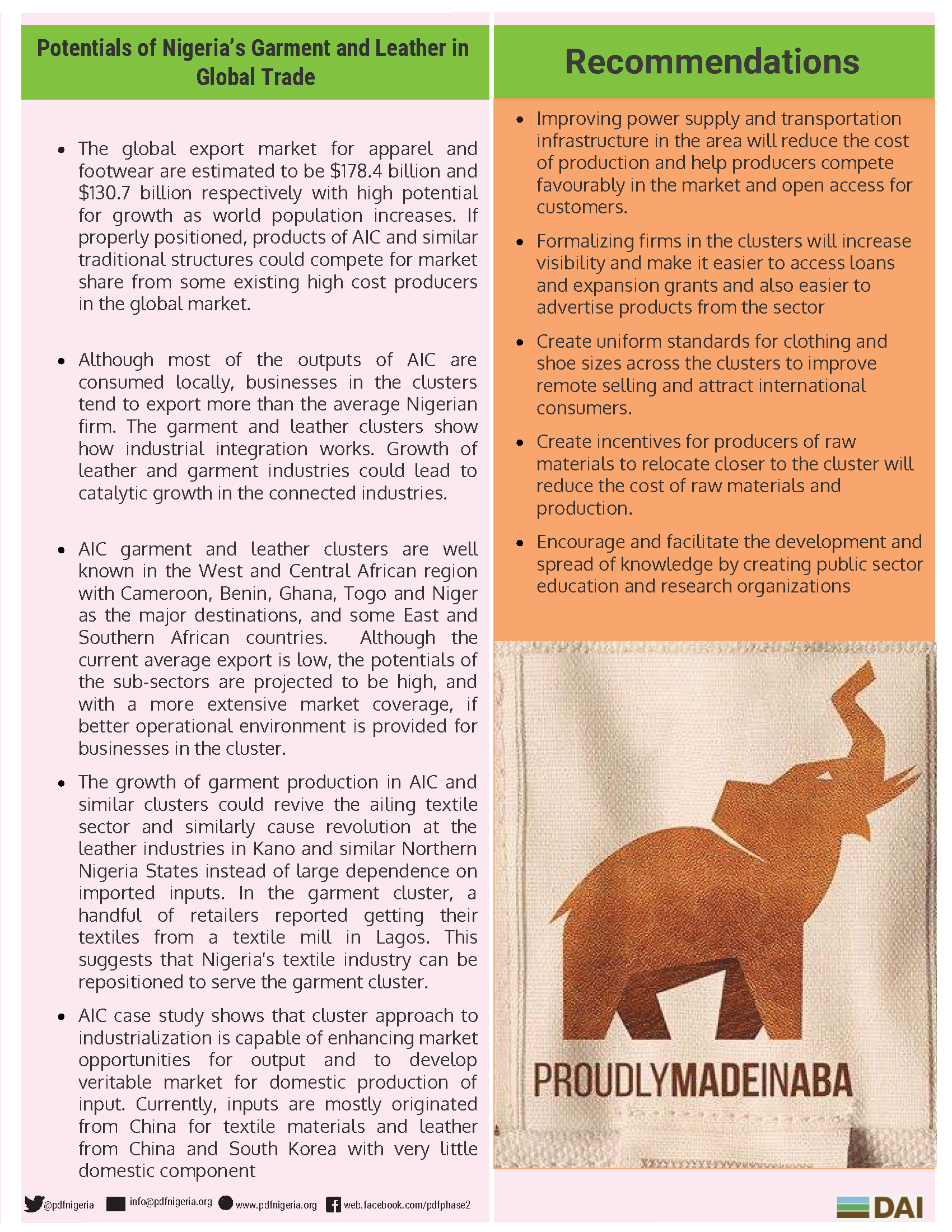

This study was carried out in 2018 and documents the factors and unique characteristics that led to the formation, growth, and relative success of the Aba cluster and gives clarity on the constraints businesses in the cluster face. Contained in this report are recommendations for increasing productivity in the cluster and in Nigeria in general using Aba as a case study. The information contained in this report will be of use to both private and public sector organizations seeking to contribute to the growth of the Aba garment and leather goods clusters.