Capacity Building for Trade Associations (Day 2)

Associated resources

PDF II held a two-day capacity building training themed: “Capacity Building for Banks and DFIs”. This is designed to explore access to finance challenges, awareness campaigns, and opportunities that non-oil exporters face with banks in accessing finance. The capacity building covered topics such as Export Industry Regulations and Documentations, payment methods and trade finance instruments, Handling export finance options, managing export risks, understanding the franchising potential etc.

Continuous and consistent implementation of the Export Expansion Grant (EEG) has been identified as crucial to the diversification agenda of the Federal Government of Nigeria (FGN). Despite its importance, however, the programme has experienced various implementation challenges and, at least, three suspensions since inception. The aim of this study is to provide evidence-based information on EEG implementation to guide relevant stakeholders to reform and reposition the scheme for greater effectiveness. The study aims to specifically analyse the impact of the grant on the beneficiaries prior to suspension in 2013 and the post-suspension implementation from 2017. It also investigates the challenges faced by beneficiaries in their attempts to access the grant. The study applied both primary through survey and secondary data through desk review to address the set objectives of the study. The survey was conducted through three methods: (i) administration of questionnaires, (ii) Key informant interviews (KII), and (iii) focused group discussions (FGD).

This report documents the strategic plan for the implementation of the Africa Continental Free Trade Agreement (AfCFTA) by Nigeria following a diagnostic review of the prevailing trade ecosystem including the participants (traders and service providers), the regulating agencies, prevailing policies, and processes as well as the level of regional integration.

Businesses that operate in a particular domain are expected to adhere to some rules and regulations. Here is a training material that covers some of these requirements. This does not take the place of legal advice.

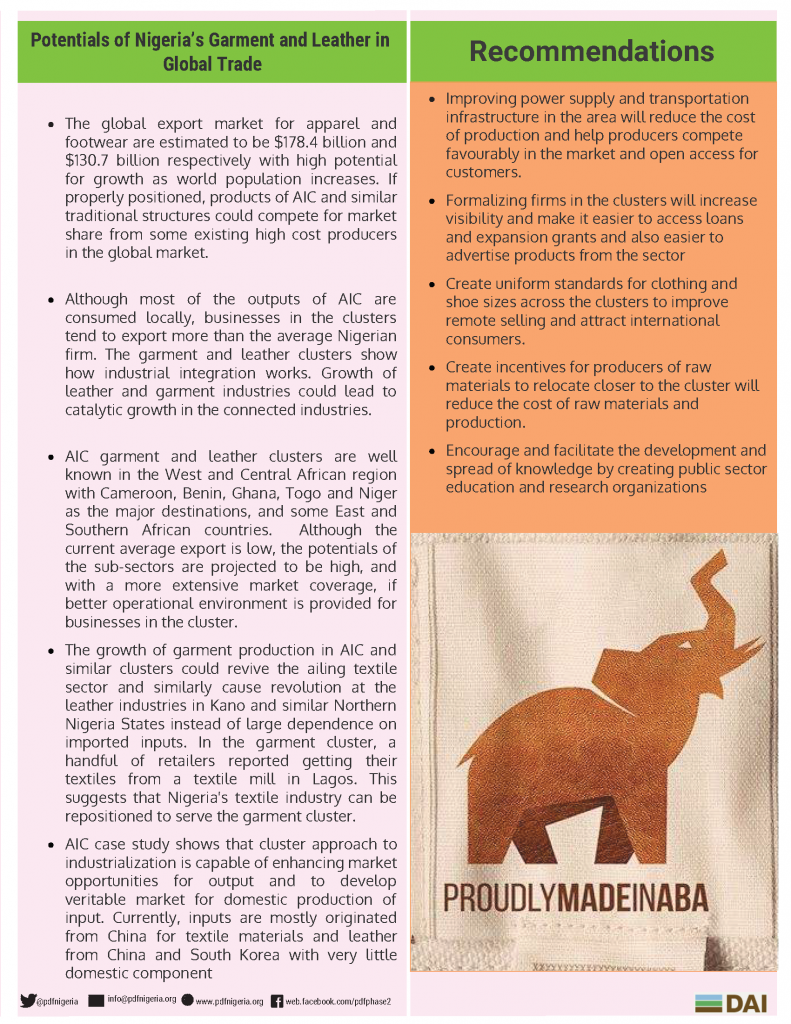

Aba Industrial City is an aggregation of thousands of MSMEs and mass producers of industrial goods including garment and leather products. If properly harnessed, the mass production capacities of component clusters of AIC and similar models are capable of positioning Nigeria at a competitive advantage in the global garment and leather industrial space. In 2016, the Textile, Apparel, and Footwear sector contributed N2 trillion ($6.6 billion), approximately 2% of Nigeria’s total GDP, to Nigeria’s economy.