This is a presentation from the second day of the Trade Associations capacity building titled – Strengthening the structure of Trade Associations in the Non-oil Export sector for better Governance and Leadership. It covers Member Relations & Communication, Advocacy and Stakeholder Management, Fundraising & Financial Management as well as Leadership & Corporate Governance.

Strengthening the structure of Trade Associations in the Non-oil Export sector for better Governance and Leadership

File type: PDF

Number of pages: 35

File size: 1023

Associated resources

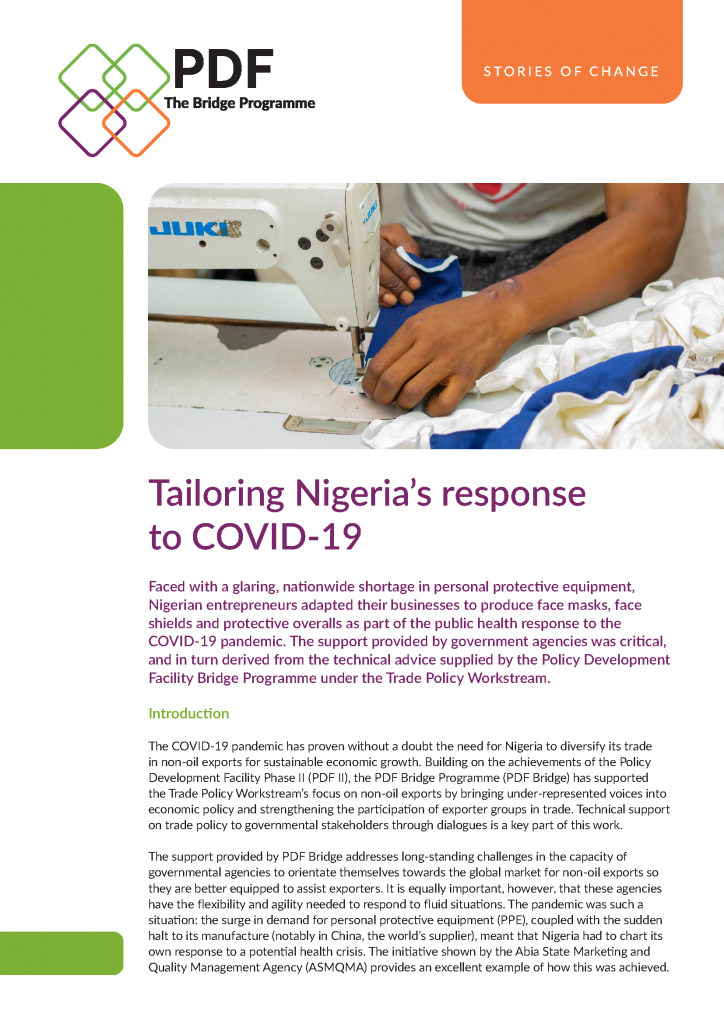

With the global COVID-19 pandemic came the need for local manufacturers to step up to the challenge and produce face masks, face shields, and PPEs due to dwindling supplies caused by high demand the world over. The support provided by government agencies to these entrepreneurs was critical, this in turn was derived from the technical advice supplied by the PDF Bridge programme under the Trade Policy Workstream through dialogues, studies, and roundtable events. The workstream focuses on non-oil exports by bringing underrepresented voices into economic policy and strengthening the participation of exporter groups in trade. The workstream engaged with representatives of Abia State Government during its dialogues particularly with the Director-General of the Abia State Marketing and Quality Management Agency (ASMQMA). This engagement led to increased capacity and redirection of strategy for the Aba Textile cluster in the production and distribution of finished goods. With help from the State Government’s agency on quality and standardization, Abia State Marketing and Quality Management Agency (ASMQMA), tailors generated an estimated $4-5million for the Nigerian economy from Abia State alone from the production of PPEs. This created a 110% increase in tailoring personnel.

Trade Associations play a role in promoting appropriate policies, regulations, and necessary reforms relating to their sector of operations. They create opportunities for networking and consultations among industry players as well as being a voice when it comes to new regulations and legislations while encouraging best practices among its members. According to Peter Gomersall[1], trade associations exist to support their members and further their interests, to defend them when they are under threats and to promote a common position on issues affecting the environment in which they operate.

Given the foregoing, the PDF Bridge Trade Policy Workstream organised a two-day capacity-building session targeted at strengthening the leadership of non-oil export-related trade associations and improve on their business strategy to position them to take advantage of the opportunities in the non-oil export value chain. The sessions had in attendance delegates from government agencies such as FMITI, NAQS, FMARD, NOTN, CBN as well as executives of trade group drawn from various industries including agricultural commodities farmers, agricultural commodities exchange and aggregators, industrialists, agro-processors, women, and youth development groups, textile and apparel among other participants.

[1] https://www.iiste.org/Journals/index.php/JEDS/article/download/7852/8030

This event report summarises the third of a series of forums aimed at improving access to finance for non-oil exporters in Nigeria. It discusses the Africa Continental Free Trade Area Agreement, trade policy negotiations and the trade policy environment in Nigeria, as well as financing options for exporters and steps to develop non-oil exports in Nigeria.

This event report summarises the fifth of a series of forums aimed at improving access to finance for non-oil exporters in Nigeria. It focuses on how exporters can gain access to foreign markets and conform to local and international standards.

PDF II held a two-day capacity building training themed: “Capacity Building for Banks and DFIs”. This is designed to explore access to finance challenges, awareness campaigns, and opportunities that non-oil exporters face with banks in accessing finance. The capacity building covered topics such as Export Industry Regulations and Documentations, payment methods and trade finance instruments, Handling export finance options, managing export risks, understanding the franchising potential etc.